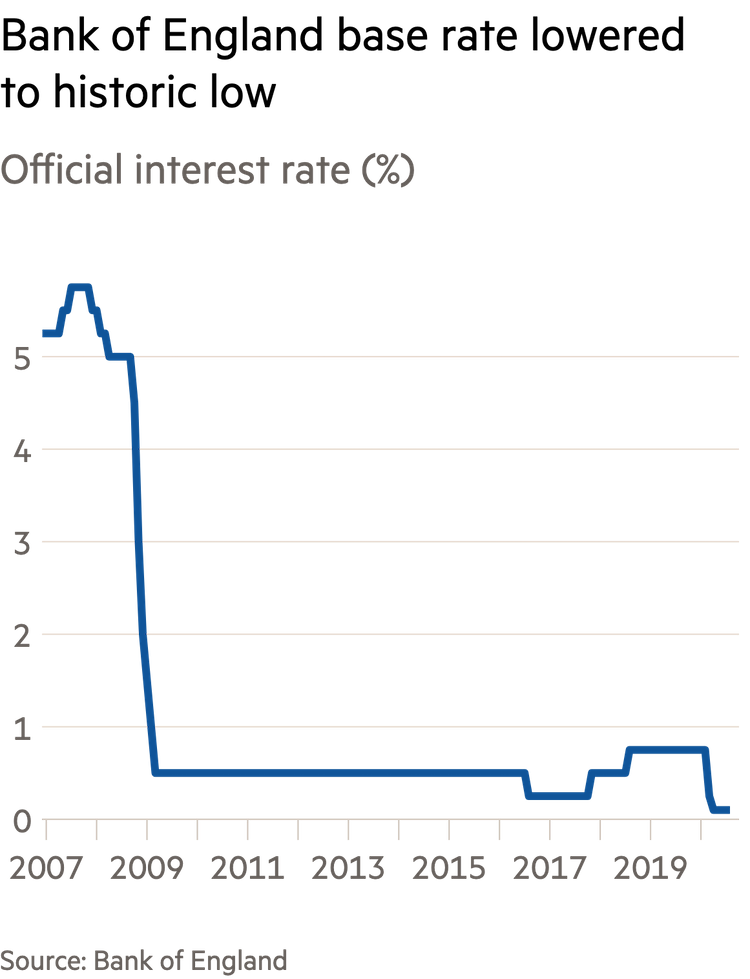

Many people manage their investment portfolio with the goal of generating an income. But when bank savings rates are low, this is notoriously difficult to achieve. Fortunately there are other places where you can put your money which have the potential of offering you better rates.

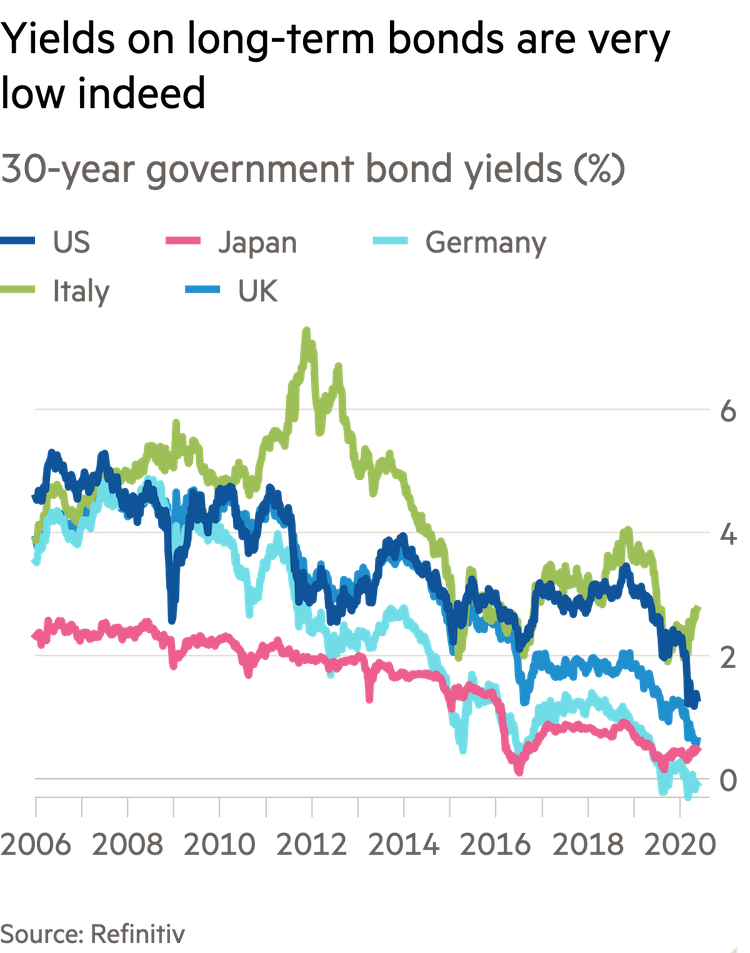

Income investors construct portfolios that will provide them with a steady income stream. This might sound like a tricky task, with bank and government bond rates at historic lows. But it is still possible if you know where to look, and understand how much risk you need to take to achieve different income levels.

What return can I expect?

Your returns will depend on how much risk you are willing to take. Investments offering very high income payments can be a sign of danger, and could lose you a lot of money. In a diverse income portfolio, an annual income of up to 4 per cent is a realistic target.

To diversify your risk, start by investing in funds.

- Bond funds

- Equity income funds

- Property funds

- Infrastructure funds

- Capital growth for income

The sections below will help you understand the different ways of investing to access regular income.

Jargon Buster

Bonds - A bond is a fixed income instrument that represents a loan made by an investor to a borrower

Coupon - The annual interest payment that the bondholder receives from the bond's issue date until it matures

Dividend - a sum of money paid regularly by a company to its shareholders

Dividend yield - a dividend expressed as a percentage of a stock's share price

Maturity - the period during which the bond owner will receive interest payments on the investment

Bond funds

When you buy a bond you are effectively lending an entity - usually a company or government - money in return for periodic payments and the promise of your money back after a fixed term.

It is worth noting that your returns will also be impacted by the bond price movements which will make the overall value of the fund go up and down.

What affects bond price movements?

- Credit rating - the less financially secure the bond issuer, the higher the bond's annual interest payment.

- Interest rates - when interest rates rise, bond prices usually fall.

- Period to maturity - normally you can expect higher rates over longer time frames.

A bond fund manager will hold tens or hundreds of bonds and trade them based on economic and market activity, and to meet investor demand and redemption. For this reason, bond fund managers rarely hold bonds to maturity. By investing in a bond fund, you are pooling money with other investors and letting a professional take care of the bond buying for you. The income you receive from the fund will paid by the underlying bond interest payments.

Types of bond funds

Some contain just corporate bonds, others government bonds, others a mixture of debt instruments. Bond funds that invest in bonds more likely to default tend to offer higher potential returns. Bonds are graded by rating agencies to determine how risky they are.

Bond Funds are...

... good for: reliable income, diversification from equities

... bad for: risk-adjusted returns

equity income funds

Equity income funds often offer higher returns than bond funds but they are also more risky.

The fund manager invests in stocks that pay dividends, collects the income and pays it out to investors in instalments, often quarterly.

Your income is not guaranteed because if a company cancels its dividend the fund will pay out less. The value of the fund will also fluctuate in line with stock price movements. This gives you an opportunity for capital growth, but also means you could lose money.

You can choose an open-ended or closed-ended fund structure. Investment trusts (closed ended) can offer more reliable payments because they can keep money in cash reserves.

What is fund yield?

The fund yield will give you an indication of how much income you might expect. Equity funds quote a historic yield figure usually covering the previous 12 months up to the last dividend declaration date and based on the fund price at that date.

Equity Income Funds are...

... good for: attractive yields, capital growth potential

... bad for: volatility

property funds

With a pooled property fund, a professional manager collects money from many investors, then invests the money directly in property or in property shares. The fund manager charges a fee for the service and the rent paid by the tenants will form your income.

Your options include investing in an open-ended property fund or in a closed-ended real estate investment trust. And there are benefits and disadvantages to both:

- Open-ended funds come with the risk that you might not be able to access your money if lots of investors want their money out at the same time and the manager is unable to sell underlying properties quickly enough.

- Investment trusts can trade at large discounts in times of stress which can impact the value of your holding.

Property funds are...

... good for: attractive income and capital growth potential.

... bad for: liquidity

infrastructure funds

Infrastructure funds invest in essential public assets, such as toll roads, airports and rail facilities.

They are often attractive to investors looking for predictable returns, as infrastructure projects are typically characterised by low levels of competition and high barriers to entry.

There are two main types and some funds invest in both:

- Social infrastructure funds operating facilities such as hospitals, schools and prisons.

- Renewable energy funds running wind and solar farms and green energy storage systems.

The reputation of infrastructure investment companies as dependable, lower-risk sources of income has made them popular. But you may have to pay a large premium to invest in the best infrastructure investment trusts.

Infrastructure funds are...

... good for: reliable, long-term income

... bad for: expensive to access

capital growth for income

In difficult market conditions bond funds tend to return very little, while equity income funds tend to be hit by companies cancelling their dividends. Property funds also struggle during times of turbulence as they tend to invest in retail properties and office space, which both struggle during uncertain times.

Another option for investors who need income is to invest in growth assets and sell stocks as you need income.

This requires careful management and you should be prepared to be flexible about when you sell assets to take your income. You should also have a cash buffer of perhaps one year so you can avoid having to sell at the bottom of a market.

There are two key benefits of this type of income investing:

- Investing in growth funds tends to produce a higher total return over long periods than investing in income funds.

- Potential tax advantages as the capital gains tax (CGT) personal allowance is larger than the dividend tax personal allowance and CGT tax rates tend to be lower.

Capital growth for income is...

... good for: total return and potentially tax

... bad for: high maintenance and high risk