Weekly roundup:

Merchant Navy gets in line as general levy returns

Welcome to Pensions Expert’s roundup of a week that saw the Pensions Regulator throwing its considerable bulk around.

The threat of enforcement action was enough to see off what was, by its own account, an extraordinarily incompetent trustee board at the Merchant Navy Ratings Pension Fund.

The working group established by pensions minister Guy Opperman to solve the small pots problem has published its recommendations. Consolidation is, as so often, the word of the week, but automation is required to circumvent the problem of “generation default”.

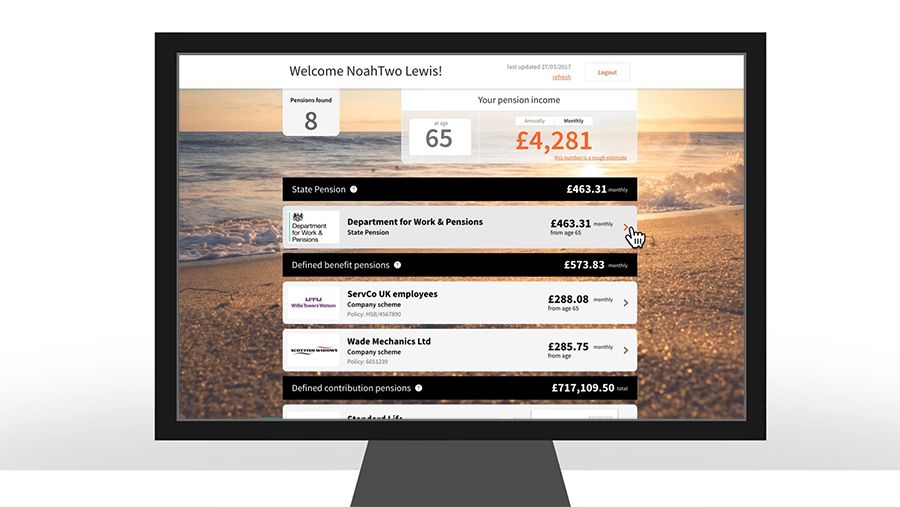

New data standards for the dashboards were released by the Pensions Dashboards Programme that are intended to provide a universal language describing the type of data submitted to and available on the dashboards, with the sensible goal of ensuring people know what it is they are looking at. But things are never quite so simple.

Finally, defined benefit schemes face the unwelcome prospect of a 120 per cent levy hike proposed in a new consultation from the Department for Work and Pensions. The different rate afforded to master trusts suggests DB schemes need to do a better job of complaining.

Guy Opperman

Guy Opperman

Why don’t we just legalise it?

The UK’s small pots problem is due a solution as the small pots working group, established by pensions minister Guy Opperman earlier this year, published a series of recommendations to the government on Thursday.

Administrative work to enable the mass transfer of small-scale defined contribution accounts should begin, the group said, with consolidation being as ever the preferred outcome.

Master trusts in particular should look to consolidate where they hold multiple pots belonging to the same person, and they, along with other large providers, should plan and conduct trials for various approaches that do not necessarily require the member’s consent.

Member-led consolidation is an option not to be discounted, but the view of the working group and several industry players is that automated systems will be essential.

Far too many people do not give a hoot — they were politely termed “generation default” by Dalriada’s Paul Tinslay — and so any total solution to the small pots problem has to accept that consolidation will, in some cases, happen on behalf of members rather than at their behest.

Pensions dashboards prototype project

Pensions dashboards prototype project

Write it, cut it, paste it, save it, load it, check it

New data standards were published by the Money and Pensions Service’s pensions dashboards project with the aim of establishing a common language that refers to the type of data collected, stored and displayed by the dashboards.

But almost as soon as the new standards were made public, the ever-efficient Steve Webb, partner at LCP, was finding fault, specifically with the provisions for schemes to set their own standards for data verification.

While the data standards are meant to apply equally to all providers, the practical effect of self-verification undermines that goal by allowing schemes to judge the quality of the data themselves, with the potential result being different schemes providing different datasets of variable quality.

In effect, this could lead to a large number of “false negatives”, Sir Steve said. If risk-averse schemes only supply data where they are “absolutely certain” of a match, this could result in pension pots rightly belonging to members not appearing on the dashboard.

Rate hikes for thee but not for me?

General Levy is shaking down his junior officers, demanding a 120 per cent hike from Private DB, though young Master Trust is in his good books and looks likely to benefit from a smaller increase.

This is the story told by a consultation launched on Wednesday by the Department for Work and Pensions.

It seems that, after a 12-year freeze in levy rates and widespread reductions over the years, somebody at the DWP has finally realised there is not enough money left to fund the ever-increasing mandates of TPR, the Pensions Ombudsman and the Money and Pensions Service.

Previous attempts to raise the levy by 10 per cent were foiled in March this year after master trusts complained bitterly that they were being unfairly targeted.

Under its preferred of three solutions, the DWP proposes charging different levy rates depending on the type of scheme.

DB schemes could suffer a 120 per cent increase over the next four years, occupation DC schemes up to 52 per cent, and master trusts by around 10 per cent, a situation Smart director of policy and communications, Darren Philp, called “a fairer distribution of levy financing” due to it sparing auto-enrolment savers from having to subsidise people with larger DB pots.

As ever with attempted cash grabs by the government, Pensions Expert forecasts a storm of complaints.