Client-centric advice in

an ever-changing world

FTAdviser Financial Advice Forum 2022

Photo: Em Fitzgerald

Photo: Em Fitzgerald

Editor Simoney Kyriakou. Photo: Em Fitzgerald

Editor Simoney Kyriakou. Photo: Em Fitzgerald

As the chancellor was finalising his speech, ready to deliver what would be the biggest 'mini-Budget' in years, the Financial Times's head office, Bracken House, welcomed delegates to FTAdviser's first in-person conference since 2019.

The flagship FTAdviser Financial Advice Forum, which took place on Thursday September 22, was built around the theme of 'client-centric advice in an ever-changing world', and it is true to say change has been the constant over the past decade.

As editor Simoney Kyriakou said in her opening statement to a packed room: "We have had the Brexit vote in 2016, welcomed three prime ministers since 2016, worked our way through Covid-19, and even this month we have seen enormous upheaval.

"On top of this, you have had to cope with new regulations such as the consumer duty, potential changes to the shape of UK regulation post Brexit, and an emergency budget set to usher in a 'new era' of Trussonomics."

The event, which was accredited by the Chartered Insurance Institute for CPD, covered a broad agenda: from a fireside chat with Caroline Rainbird, chief executive of the Financial Services Compensation Scheme, to a discussion on the consumer duty rules; from the future of professional indemnity insurance, to ways to inflation-proof your clients' portfolios; and from the difficulties of defined benefit transfer business to conversations with clients around thematic investing.

The following feature presents an overview of the full day, but you can watch each session on demand for the next 30 days using this link.

Building sustainable advice businesses to serve the next generations of clients

Simoney Kyriakou

How do we make sense of the past to help clients in the future?

This was the overriding question of the day at FTAdviser's flagship Financial Advice Forum, as panellists and delegates alike discussed how the world of financial advice has changed significantly over the past 10 years – and is set for even more changes in the years ahead.

Following the opening remarks, which were accompanied by a spread of baked goods, fresh breakfast rolls and strong coffee, the first panel discussed why 2022 was the ‘Anniversary year’.

Tish Hanifan, founder of the Society of Later-Life Advisers; Sarah Lord, past president of the Personal Finance Society, Rob Sinclair, chief executive of the Association of Mortgage Intermediaries, and Derek Bradley, founder of Panacea Adviser, took delegates on a whistle-stop tour of regulatory intervention from 2012 to 2022.

They looked at the Retail Distribution Review and the ongoing aftermath of the advice gap; how auto-enrolment in 2012 has helped millions of people get started on their pension journey, but how more needs to be done; discussed the problems caused by pension freedoms in 2015, and a wealth of regulatory reforms and progression that will be needed to help advisers and their clients through the next 10 years.

As Hanifan commented: “Regulation is like a marriage – you are sort of in love with the idea of it, but you spend too much time in the engagement period.”

Following this, Caroline Rainbird, chief executive of the Financial Services Compensation Scheme, spoke with FTAdviser’s multi-media editor Carmen Reichman about the levies, why the FSCS is necessary and where potential problems lie.

Rainbird told delegates: “Sadly, there are a number of bad players – deliberately or misinformed – that come into the industry, cause immense damage and ripples across many areas, and that’s the type of financial advisers that we see unfortunately.”

Alongside highlighting poor financial advice, Rainbird explained that pension advice in particular was a growing area for the FSCS.

“[It’s] extremely complex [and] extremely upsetting for customers who have to come and see us, but a growing area of our work is on those complex mentioned claims,” she said.

Regulation is like a marriage – you are sort of in love with the idea of it

Delegates could choose whether to remain in the main area for the next session, which was on the new consumer duty rules, or join a roundtable on how to spot the red flags when making environmental, social or governance investment recommendations to clients.

During the session on the new consumer duty regulations, Therese Chambers, director of consumer investments for the Financial Conduct Authority, told delegates they should take the rules “seriously”.

She said: “This is a significant regulatory initiative – we are trying to raise standards in this sector.”

Another panel session followed, this time on how advisers could help clients to inflation-proof their portfolios.

Fund manager Roger Skeldon, from sponsor Time Investments, said there was “no perfect protection from inflation”, especially in the short to medium term, but focusing on specific funds with a long-term vision is helpful.

When asked if he was seeing a ‘flight to safety’ towards alternative asset classes, given the challenging environment the UK is in at the moment, Skeldon said he was seeing different behaviour in aspects of real estate and real assets, like renewable energy.

Shut up Anthony, you're dead

After a brief break, during which delegates could network and explore the stands from the event’s sponsors – WisdomTree, Morningstar Wealth Platform, Time Investments and Octopus – features editor Melanie Tringham sat down with a panel of guests to discuss the challenges and opportunities presented by next-generation financial planning.

Colin Lawson, founder of Equilibrium, said: "We hold death rehearsals with clients.

"I get them in a room and I say 'Shut up Anthony, you're dead' – and he isn't allowed to speak. This way you get to find out all sorts of things – that wills haven't been signed or his dependents don't know where the wills are or what Anthony's passwords are."

A second panel followed, this time focusing on how retirement income landscapes have become increasingly complex, with self-managed investments, drawdowns and later-life lending emerging as options for over-55s.

The panel explored how advisers can best navigate this labyrinth of options to produce the best retirement outcomes for clients.

A lunch buffet was served – providing a chance for more networking as well as allowing delegates to get their step count up – before the afternoon sessions began.

Mega-trends and digital transformations

The first session after lunch was on the mega-trends that sit above a client’s portfolio. Mobeen Tahir, director of research at WisdomTree, spoke of the need for flexible thinking about approaching mega-trend investing as things change.

He said: "We can talk about hydrogen now but maybe five years in the future we will have something else in this space – so you need flexibility."

Do not scrimp on the level of detail you give to insurers

Also speaking on the panel was Tanya Pein, investment specialist for In2 Planning, who said: "I'm very much in the listening business – what do clients want with their money? Then we can introduce clients to ways they can future-proof their portfolios."

This session was followed by a panel on defined benefit transfers, which continues to be a hot topic for advisers who seek to effectively manage client pensions.

Guests discussed some of the biggest challenges and opportunities facing advisers in the pension transfer space, as well as what the latest guidance says.

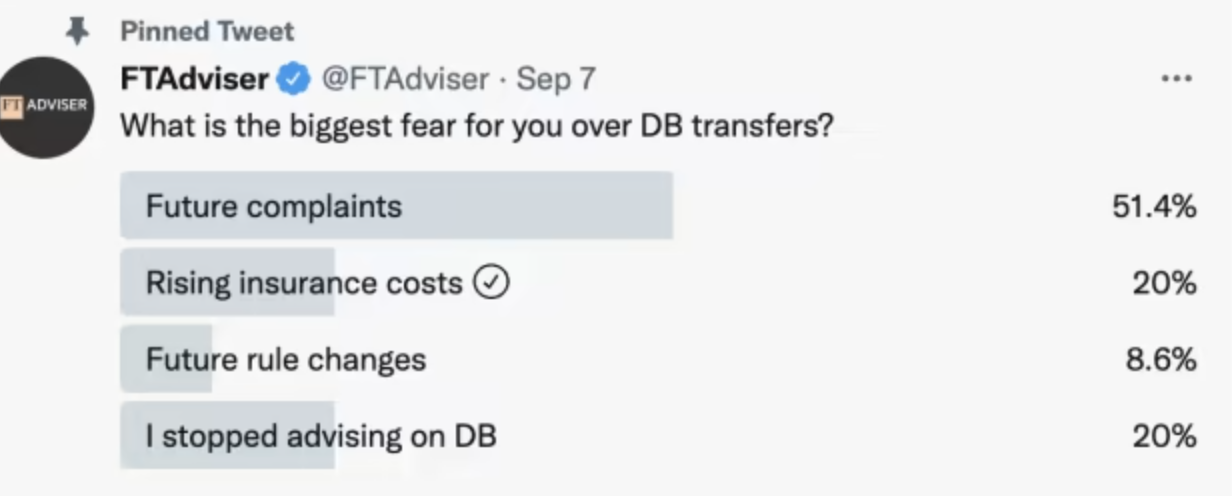

Indeed, a poll carried out ahead of the Forum found that more than 51 per cent of advisers were worried future complaints might arise if they carry out DB transfer advice.

Continuing the theme, 'DB is a headache', it certainly can be a problem when it comes to attempting to sell your firm, according to Brian Hill, head of strategic exits at The Exit Partnership, who was speaking on the next panel session. This explored exit strategies and how to succession-proof an advice business, as well as what to watch out for when making an exit plan.

This was held at the same time as a roundtable on the future of buy-to-let. The consensus from advisers at the break-out discussion was that the government really needs to prioritise first-time buyers rather than offering support or tax breaks to buy-to-let investors.

After another coffee break, delegates could once again choose which session to attend: a discussion on the pensions dashboard, led by sister title Pension Expert's deputy editor Alex Janiaud, or a practical session on how to have the professional indemnity conversation with your insurer, chaired by deputy features editor Ima Jackson-Obot.

During this session, Melony Holman, compliance consultant for Compliance & Training Solutions, and Toni Sheen, director of PI Financial, fielded dozens of questions about what advisers need to do to get the right level of PI cover.

Some top tips included:

- Making sure all your percentage splits of business revenue add up to 100 per cent.

- Send typed, rather than handwritten forms.

- Check you have the correct dates.

- Make sure you do a thorough check if there are any potential complaints.

Sheen said: "Do not scrimp on the level of detail you give to insurers."

Jackson-Obot remained on the stage to welcome Derek Smith, head of technology at Morningstar Wealth Platform, who highlighted the opportunity to use technology to reach people who had not yet engaged with an adviser.

His comments, along with those of his fellow panellists, are outlined in the news feature below by Chloe Cheung.

And if people thought the last session – an interview with Susan Ball, president of the Chartered Institute of Taxation – would be an easy way to end the day, they were wrong.

During the afternoon, the government had leaked its intentions to scrap the controversial 1.25 percentage point national insurance/social care levy hike, as well as unravel some of the IR35 reforms of recent years – so there were plenty of questions to field.

The day ended with some much-needed refreshments in 1888 – the Financial Times's restaurant.

What can the changes of the past 10 years tell us about the needs of tomorrow's client?

‘I don’t have to sell to clients; they’ve already bought into me’

From right: Sam Secomb, Women's Wealth; Emmanuel Asuquo, Belvedere Wealth Management; Derek Smith, Morningstar Wealth Platform; Ima Jackson-Obot, FTAdviser. Credit: Em Fitzgerald

From right: Sam Secomb, Women's Wealth; Emmanuel Asuquo, Belvedere Wealth Management; Derek Smith, Morningstar Wealth Platform; Ima Jackson-Obot, FTAdviser. Credit: Em Fitzgerald

In an industry that relies on relationships and rapport, establishing a social media following has helped one adviser cultivate clients before meeting them one-to-one.

Speaking at the Forum, Emmanuel Asuquo, senior partner at Belvedere Wealth Management, said: “Where social media has helped me is that I don’t have to sell to my clients.

“They’ve already bought into me. They already follow me, they already know me. In fact, it’s a joy just to have a meeting with them. [They say things] like ‘Oh, I can’t believe it’s actually you!’”

At Asuquo’s firm, being online has also made advice more accessible. “We want to try make sure that advice is given to everyone; that anyone that wants to invest can get advice, which is difficult, obviously, with time and so forth.

“So we’ve recently partnered with [online advice and investment platform] JustFA to try and get everything in one. The client can do a bit more of the heavy lifting, rather than us having to do everything ourselves."

He said clients are happy to do that, at a lower fee. So it helps both parties, because he said they know as advisers that the advice gap is just getting bigger.

We want to try make sure that advice is given to everyone; that anyone that wants to invest can get advice

Asuquo added: “It’s great to say, ‘I want a client that has £100,000’; but coming from the kind of backgrounds we’ve come from, how do you get to £100,000 without someone giving you the advice on how to be better with £1,000 or £10,000, and so on.

“If we all run away from them, the gap just gets bigger, and so for us it’s really important to have the technology to allow us to support people from those types of communities.”

Also on the panel was Sam Secomb, founder and CEO of Women’s Wealth, which she described as a virtual business that meets clients ‘screen-to-screen’.

Secomb said using technology made “being there” with clients easier, and likewise cited cost as an advantage of incorporating technology into her business model.

I’d lean into the opportunity rather than the risk

“We wouldn’t have been able to do what we do, at the price we do it, without the technology that’s helping us deliver it,” she said.

Another benefit of running a virtual business, said Secomb, was the environmental effects.

“I think we definitely don’t pollute the air so much with travel to clients… it is unusual for us to be out in person, to the point where we don’t have business cards anymore. Everything’s virtual, and I think that is environmentally friendly.”

With Secomb and Asuquo both using technology to make advice more accessible, Derek Smith, head of technology at Morningstar Wealth Platform, which sponsored the panel, likewise highlighted the opportunity to use technology to reach people who had not yet engaged with an adviser.

Citing a figure that only 7 per cent of people in the UK had sought advice, Smith said: “You guys have got 93 per cent to go after. As you said, you’re starting to use technology to try and lower the cost. I think look at those opportunities.

"I would look and say, what’s the next 10 per cent you can go after, and how can technology help you engage with them by lowering the cost to serve in your business? I’d lean into the opportunity rather than the risk.”

Speakers and delegates at the FTAdviser Financial Advice Forum 2022

House view: WisdomTree

Megatrends allow people to more directly connect with the big, transformational changes that are influencing the course of human history. Over time, we have seen things like the Industrial Revolution, electricity, the internet and social media change the world.

The concept of identifying, and investing in, companies that change the way humans live is not a new one so, arguably, ‘thematic’ investing has been around for decades. We may just have formerly called it by different nomenclature, like ‘growth’. People might think of companies like Amazon.com and Alphabet in the early 2000’s as the prototypical examples of what people ‘hope’ for when making a thematic investment, but we may not have been as explicit in calling specific strategies ‘thematic’ at that time.

For those investors looking at thematic solutions today, there is a sizeable universe to navigate, with over 1,000 different thematic funds to choose from. To help make sense of it all, WisdomTree has classified each of these funds to 1) understand the layout of the space 2) group funds together focused on similar topics and 3) be able to denote summary information, like investor flows and performance.

This is a database that we maintain, and it helps ensure that we have a view of not just WisdomTree’s own thematic funds, but rather the vast array of options that investors face.

As each theme is different, the companies within each theme must be analysed in their own specific way. While WisdomTree is no stranger to fully rules-based, passive strategies, we didn’t feel those represented the ideal approaches within thematics.

In certain cases, we have benefited from unique collaborations, where external firms with expertise in the topics in question provide data that helps to inform the specific company selections.

In other cases, WisdomTree has internal expertise to look at companies within particular themes. The key for us is each company within each theme must be able to be looked at in its own, bespoke way to ensure it properly fits the theme.

Thematic investing is exciting but it’s important for investors to adhere to the key investing principles that have existed in portfolio management for many decades.

Thematic investment is about tapping into the long-term potential of megatrends, not about chasing the next Tesla.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Find out more:

To watch the videos of the event on-demand, click here