Retirement is coming. Maybe not for many years but it is coming.

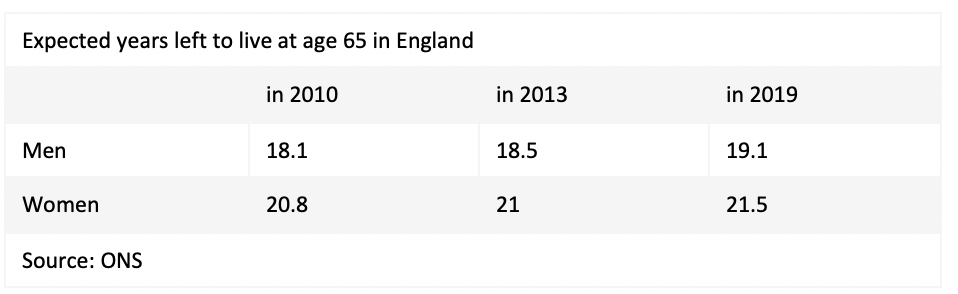

On average, you are likely to spend at least 20 years in retirement. For some people, it will be much longer. This means one thing: during your working life when you are earning an income, you need to invest some of it for your future.

The good news is that you don’t have to build a pension pot all on your own. The government will chip in too. That alone makes saving for a pension worthwhile, but if you have an employer, they will make contributions too. These additional contributions make a big difference to how much you will eventually save.

Jargon Buster

Defined Contribution Pension - A pension pot based on how much you paid in

Defined Benefit Pension - A pension pot based on your salary and how long you worked for your employer

Annual Allowance - The maximum savings into pensions that you can have in a year that qualify for tax relief

Take full advantage of workplace pensions

Most people start saving for a pension when they get their first proper job. Employers have to offer you a pension if you are earning more than £10,000 and are aged at least 22.

Defined contribution schemes

Defined contribution, or money purchase schemes create a pension pot from the money you and your employer invest over the duration of your working life.

1. Auto-enrolment

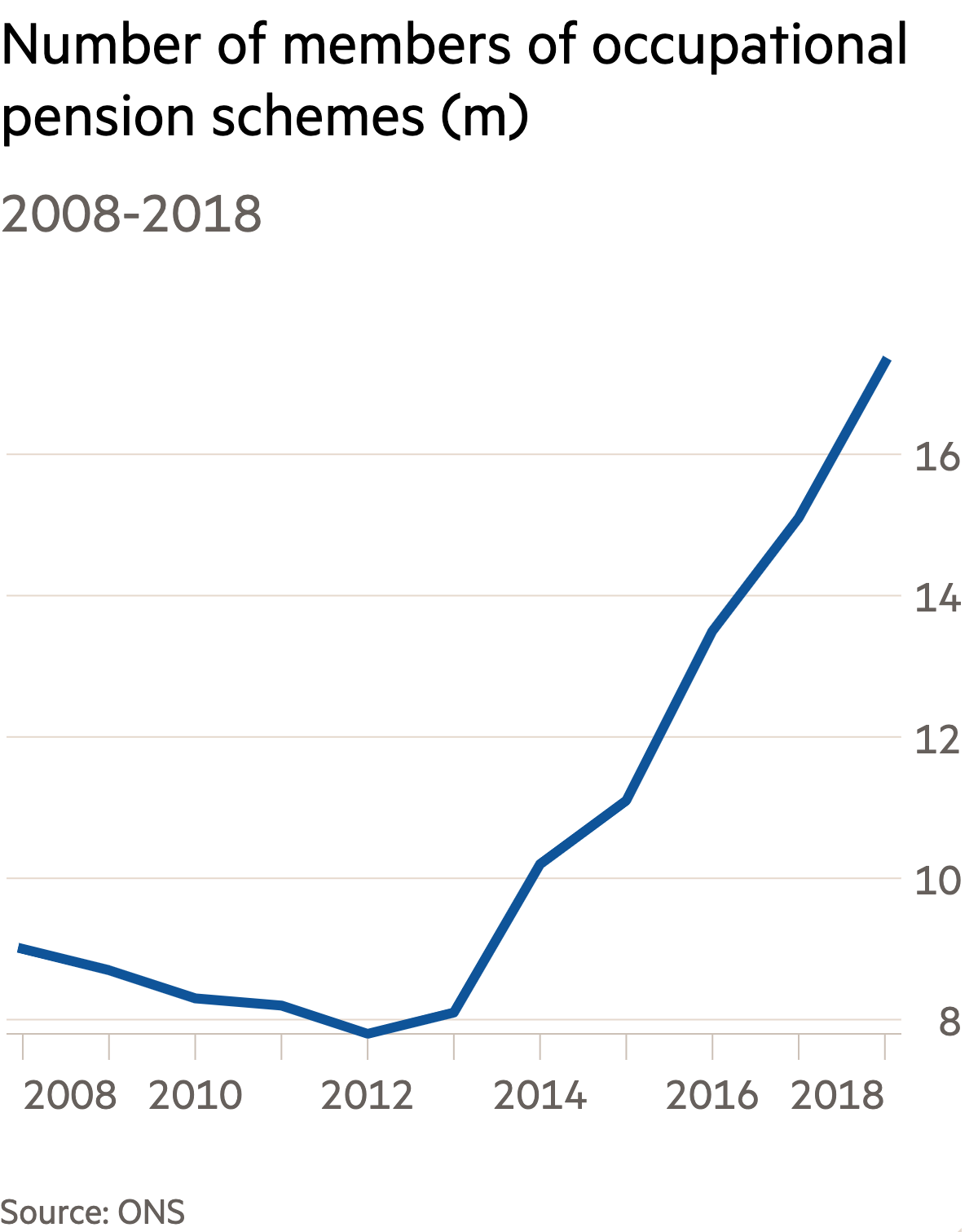

The most basic workplace contribution pension is an auto-enrolment plan - as the name suggests, you will automatically be enrolled into it, although you can opt out. Auto-enrolment schemes are run by providers such as NEST and True Potential. These plans are great because they get people saving for a pension but on their own they are unlikely to deliver the size of pension you need.

2. Workplace schemes

Big, well established employers tend to offer their employees pensions run by insurance companies (such as Scottish Widows, Aviva or Legal & General) and often make more generous contributions than simple auto-enrolment schemes. These plans offer a wider range of investment choices, and you can have a say in where your money is invested.

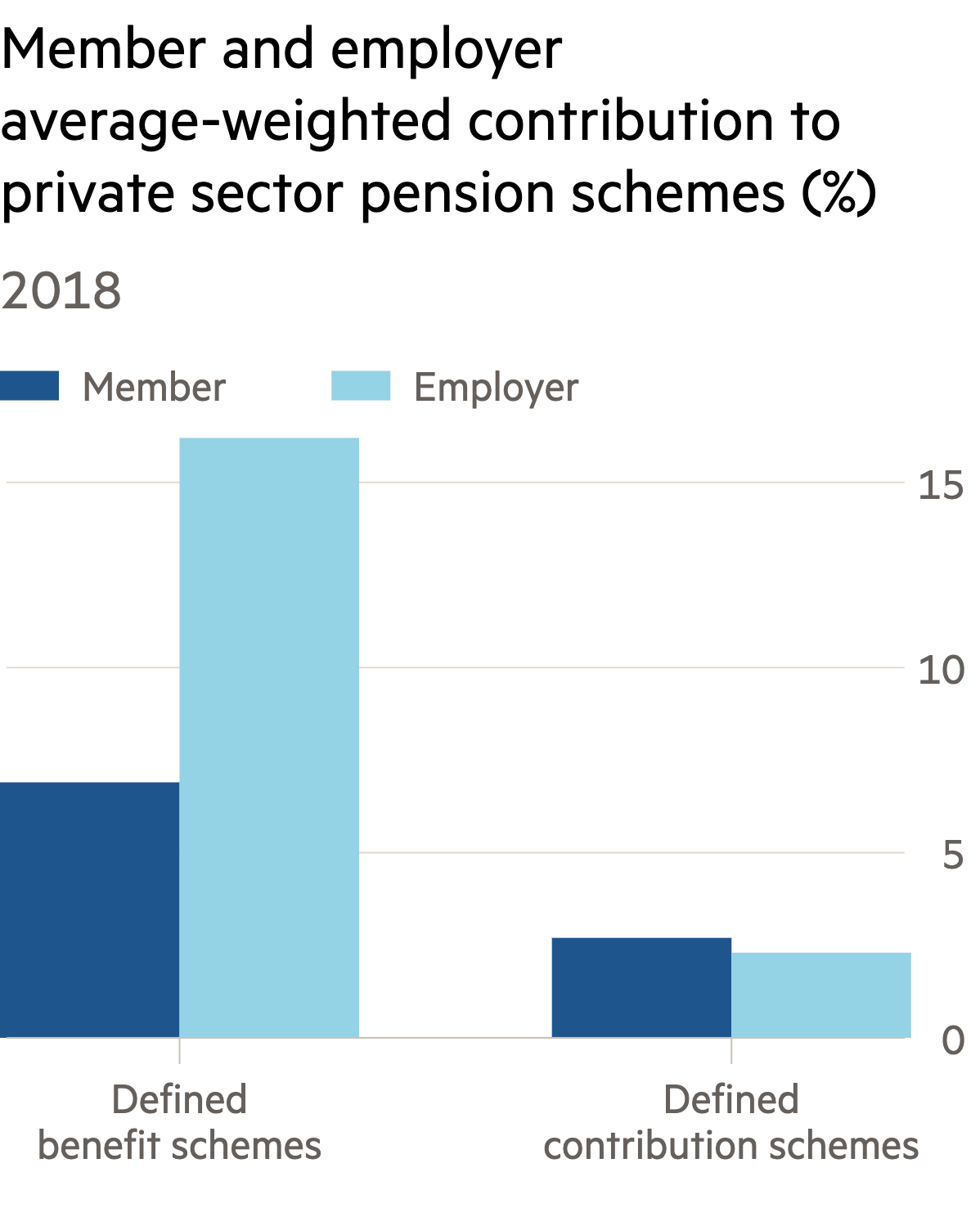

Defined benefit schemes

Some lucky employees will be offered a defined benefits plan. Here, what is known – or guaranteed – is the amount that will be paid out at the end of your working life regardless of how well or badly your contributions have performed. If you are offered one of these, grab it with both hands.

DON'T MISS OUT

If you have been automatically enrolled in a workplace pension scheme, at least 8 per cent of your salary has to be paid into the scheme. But this doesn’t mean you lose 8 per cent of your salary – your employer has to contribute a minimum of 3 per cent so you might pay 4 per cent with the rest covered by the taxman. Some employers will match or double match your contributions so if you put in 6 per cent of your salary they will add 6 to 12 per cent on top.

If you opt out of the company scheme or pay in the bare minimum, you could be turning your back on an awful lot of free money.

what if you work for yourself?

Employees have someone pushing them into a pension at the earliest opportunity. If you’re self-employed, it’s all too easy to ignore the issue of your own pension, especially when you are starting out. Your income might be erratic or loan repayments could be your top priority. But finding a suitable provider and saving for a pension is vital for you too.

There are a few different options for pensions for the self-employed, which we will run through here.

Private pension

Insurance companies like Aviva and Scottish Widows don’t only offer workplace pensions, they also have options for the self employed. They can make all the investment decisions or you can make the selections yourself.

Self invested personal pension (Sipp)

Another option is to set up a self invested personal pension (Sipp) and to manage this plan yourself. With a Sipp, you can invest in a broader range of assets including your own commercial property. This can be a great way to boost your pension and your business at the same time.

Managing your own pension can seem a little overwhelming, but there are several advantages to using them. Here are 3 key benefits of a Sipp:

1. Anyone can open their own Sipp, even if they are paying into another pension.

2. You can make extra pension contributions and pick up additional payments from the tax man as well as maximising your chances of having a good pension in later life.

3. You don’t have to be a highly experienced investor to manage a Sipp. You can simply invest in funds which can give you exposure to a wide range of companies. More experienced investors can add individual shareholdings.

The Investors Chronicle has plenty of ideas and hints for managing your own Sipp. Every year we run an annual Sipps guide and run top funds and ETF guides which can help you make sensible investment choices.

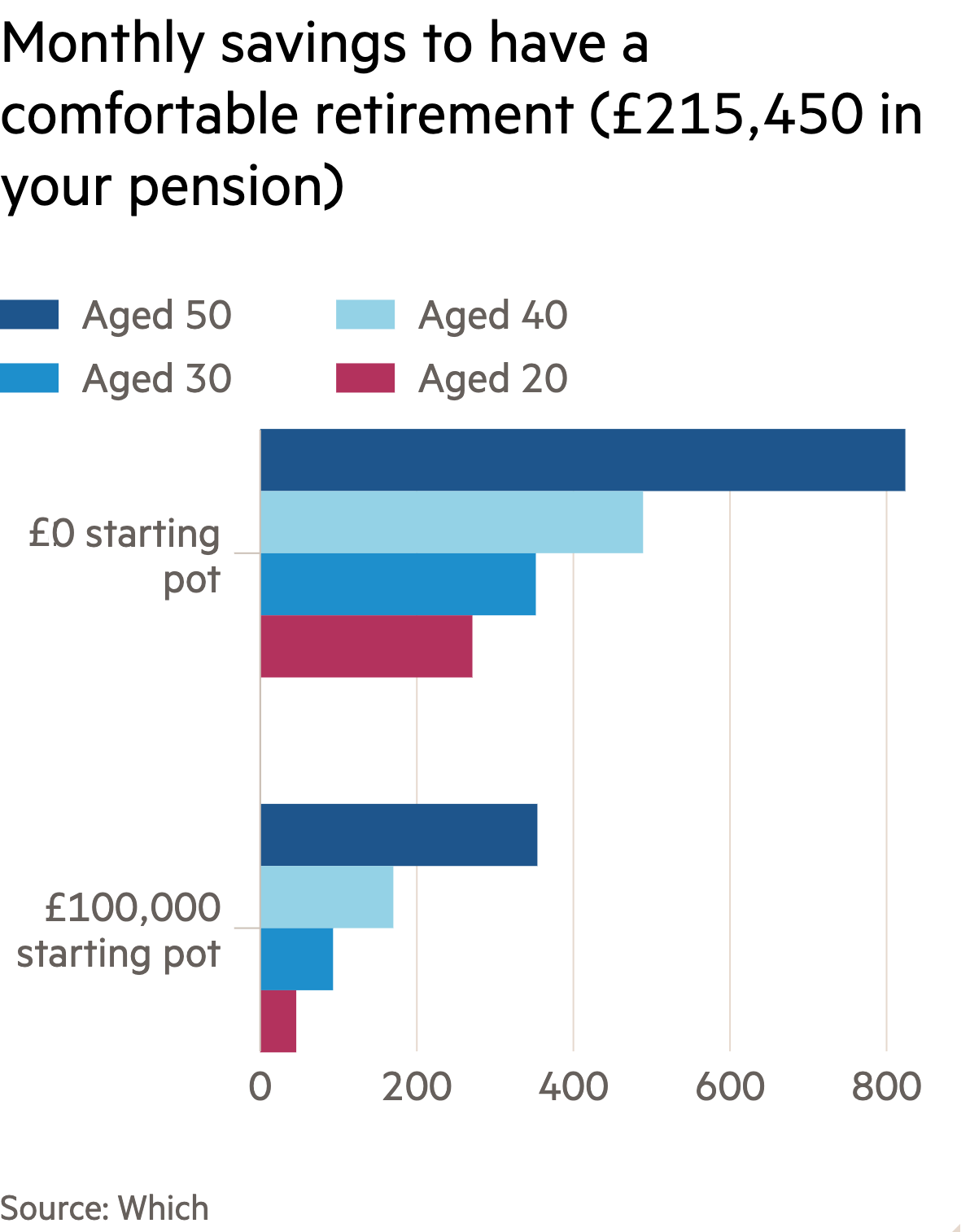

Think you don’t need a pension? You do

Some people hesitate when it comes to starting a pension. It’s a big commitment and the money you invest will be locked up for a long time. But what you get back will be hard to beat. You are not losing the money, you are growing it and claiming free money from the government. The later in life you leave it, the smaller your pension will be unless you make up for lost time with hefty contributions.

Let’s look at some common objections.

“I won’t be able to take my money out until I am 57, I might need the cash before then, perhaps for a house”

Buying your own home is obviously a key and worthwhile goal. But it is better to find a middle way – make the sacrifices you need to find a house deposit elsewhere rather than condemning yourself to pension poverty. At the very least aim to also pay something into your pension.

“Buy-To-Let is a much better idea. My home is my pension”

There are many different ways to save for retirement. Some people say their “buy to let properties are their pension”. But property comes with its own risks – it is not very liquid (it can take many months, even years to sell), tax rules can change meaning you might have to hand over a big chunk of your property profits to the tax man (compare that to pensions where the taxman is paying YOU) and you might have difficult tenants who do not pay their rent.

“I will start when I am 30, that’s plenty of time”

The more you (and your employer and the taxman) pay in, and the longer you pay in, the bigger your pension will be.

“Markets are crazy right now, I will wait until things change. And anyway, I can’t afford to put money in right now”

Timing the market is an impossible thing to do so there really is little point hanging about when you are investing for the long term, although you might prefer to drip feed money in rather than paying over a lump sum.

“I don’t need to worry, I expect to inherit money and a property”

Your future income is at stake, you shouldn’t rely on factors which are out of your control. And besides, why wouldn’t you want to add the tax breaks on offer on top of the money you are expecting to inherit in the future.

The truth is that a proper pension is a very valuable thing and will earn you generous handouts in the form of tax relief. By all means combine it with other savings and investments but whatever you choose to do, start a pension.

Six tips for maximising your pension

1. Save the right amount

You can increase the regular contributions you make into your workplace/private pensions – especially when you get a pay rise.

2. Top up when you can

Fill in any gaps in your pension savings record by making additional/top-up payments when you can afford to - the earlier you do this the greater the difference it will make in years to come.

3. Remember your unused allowance

If you receive a big pay rise, for example through promotion, new job or business success, and you pay in the maximum allowed into your pension, consider using up unused pension allowance from the three previous years. This allows you to max your contributions and claim a big chunk of additional tax relief.

4. Salary sacrifice

Say yes to salary sacrifice if it’s available but bear in mind that if you are applying for a mortgage your annual income will appear lower to a lender.

This is where you give up some of your monthly earnings and your employer puts it towards your pension contributions. As it comes out of your pre-tax salary and straight into your pension, you will pay less national insurance (NI) so your take home won’t be reduced by as much as the extra amount going into your pension.

5. Don't lose sight of charges

Keep an eye on charges, particularly if you have to choose your own pension, and be prepared to switch if they are high. Costs can reduce the value of your pension by tens of thousands of pounds.

6. Engage with your company pension

Check that you are happy with the selected retirement date given in your plan. If your plan’s default pension age has been set too early you will be moved out of high-growth investments years before you need to be. Analysis from Aviva shows that an average earner could miss out on between £4000 and £10,000 by sticking with an incorrect retirement date. Check too how your workplace pension money is invested. If you have some investment knowledge, you might decide to switch into funds that give you a greater exposure to equities for longer.

FAQs

What is the most I can pay into my pension each year?

Most people can pay up to £40,000 from earned income into a pension each year and receive tax relief on that amount. Contributions from an employer count towards that amount. There are restrictions for the highest earners however and there is also a lifetime limit to the size of your pension pot which is currently £1,073,100.

How does tax relief work? And how do I get it?

Tax relief is given on your pension contributions so it’s as if you paid no tax on the money you put into your pension. It is given at the highest rate of tax you pay. In England if you are a basic rate taxpayer, for every £80 you pay into your pension, the government will add £20. Higher rate taxpayers get 40 per cent tax relief so each £60 paid is topped up by £40, and additional rate taxpayers receive 45 per cent tax relief.

Most workplace pension plans will claim the tax relief at source so you don’t have to do anything. Where this is not the case, then you must claim back the tax relief from HMRC through your annual self assessment tax return.