Stockpicking after

the sell-off:

Optimising portfolio allocation

in a changing market

Sponsored by

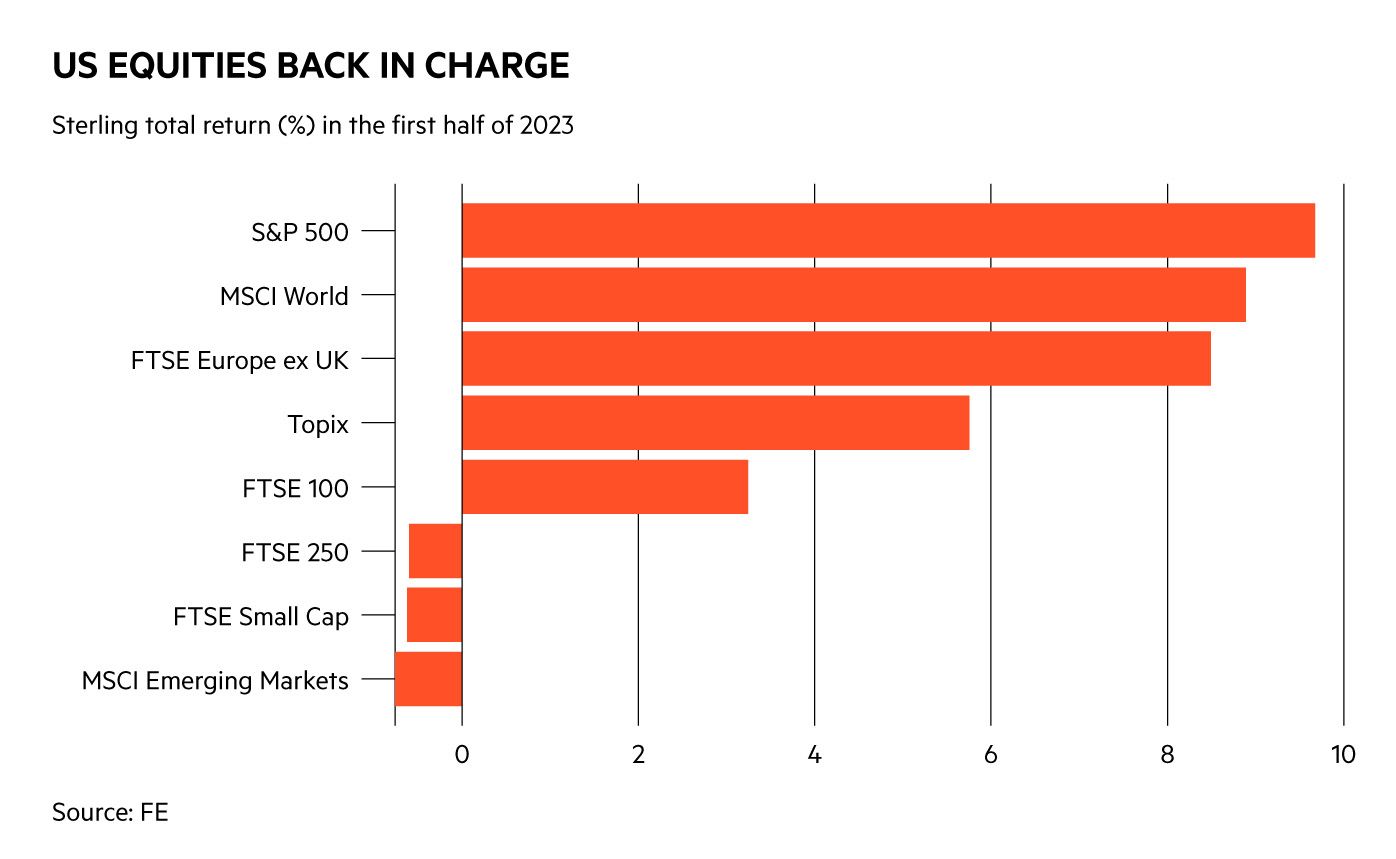

Sticky inflation, rising rates and an ever-present fear of recession seem to have done little to put investors off their stride in 2023. The S&P 500 is up by nearly 10 per cent in the first half of the year, with Europe, Japan and UK large-cap stocks also rallying hard. Difficult as 2022 was for major stock markets, recent performance seems to betray a sense of optimism.

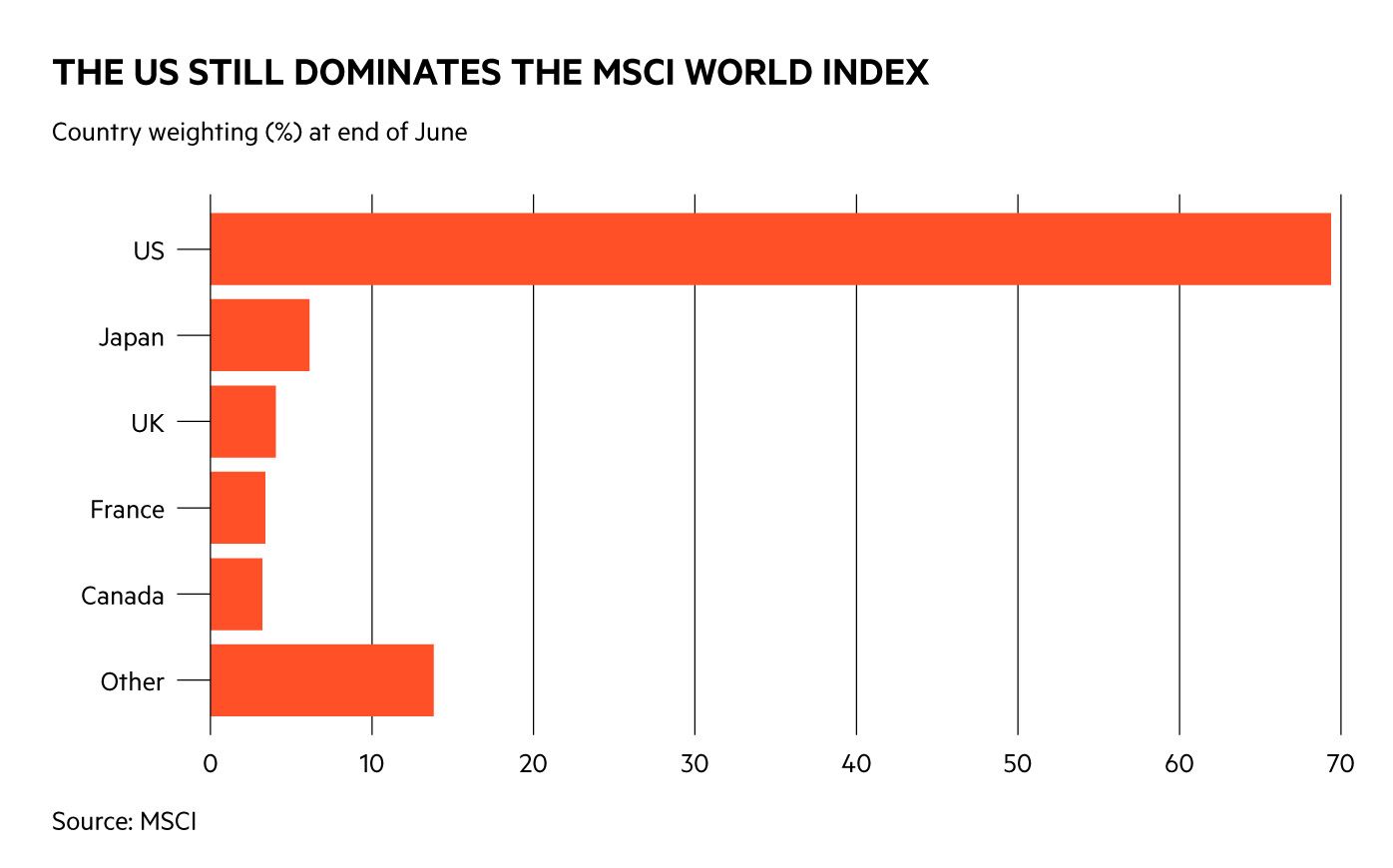

And yet stockpickers face plenty of challenges. Fears of an economic downturn have not abated, inflation is yet to materially fall back, and some familiar problems from previous years have resurfaced. The US equity market may have bounced back strongly but much of those returns seem to ride on the back of just seven stocks and a degree of hype around themes such as artificial intelligence. Investors would therefore be right to ask exactly where to invest – and what traps to avoid.

The latest Investors’ Chronicle webinar, “Stockpicking after the sell-off: Optimising portfolio allocation in a changing market”, seemed to throw up some positives for those happy to put some risk back on the table. Panellists in particular had arguments for sticking with the likes of US stocks even in the face of the now well established concerns about a rally seeming narrow, or the likes of the tech majors looking expensive by traditional metrics such as price/earnings ratios.

Julian Bishop, co-lead portfolio manager on the Brunner Investment Trust, noted that the US had earned its premium valuation over other markets in many senses, from the ease of doing business there to strong education systems and a depth of available capital. As others argued, such a system has helped the success of companies including the big tech stocks, which remain difficult to compete with.

On that note, there’s an argument that investors can overlook the potential of a share by thinking too much about its price tag rather than the company’s trajectory for growth. As Rebecca Shepherd, partner for investment management at Evelyn Partners, observed, investors could have paid 600 times earnings for shares in Apple at the time the development of the iPhone was announced and still have kept pace with the S&P 500 over a period since. That’s a reassuring fact for fans of names such as Nvidia, seen as good plays on themes such as AI that do trade on seemingly high valuations.

Where else to look beyond the world’s biggest market?

Responding to a question about whether the UK market appeared to be a value trap after underperforming for many of the last few years, Investec head of research Pela Strataki made the case for drawing a line between large-cap names such as the miners and companies further down the market cap scale.

She views the likes of miners as attractive given their strong dividends and sustainable profiles – but warns that small and mid-cap companies could face challenges in the near to mid-term thanks to their sensitivity to the fortunes of the UK economy at a time when tighter monetary policy could cause real pain. That may well give pause to investors eyeing up the smaller companies whose shares sold off especially hard in 2022.

Turning to another sector with a notable presence in the FTSE 100, the panel had good things to say about banking shares – with some caveats. Bishop, for one, argued that it was “very hard to say any bank is a really good quality business” thanks to a poor record of value creation and returns on invested capital in addition to a good level of cyclicality and the ever real risk of bank runs. However he, like some others, accepts the argument that banks look much stronger after a decade of recapitalising, leaving them ready for challenges ahead but also cash-rich enough to distribute money to shareholders.

This could also apply in markets such as the US, too – though panellists such as Shepherd believe that the larger banks look steadier than the likes of regional US entities. The rise of social media and online banking could make bank runs quicker and more brutal for those institutions that do run into trouble.

Turning to other markets, the specialists expressed a good deal of scepticism about the Chinese market, which has so far failed to deliver the great gains expected from the reopening trade of 2023. Shepherd warned that an inefficient allocation of capital continued to hold Chinese companies back – with the likes of construction companies too indebted to embark on many new projects.

As Shepherd noted, the story of Chinese GDP growth does continue to appeal. There’s therefore a good case for accessing that economic growth indirectly by backing the likes of developed market luxury consumer goods companies. Bishop made the case for this, as well as backing other consumer names such as Diageo as a play on popular regions like India. Tricky as the usual allocation questions are, there still appear to be plenty of good opportunities.

Sponsored by